News

“Our message is simple … drive safe, drive sober and buckle up,” said Lt. Dane Hayward, Commander of the Clear Lake Area CHP office.

To emphasize safety on the roadways, the CHP has scheduled another Maximum Enforcement Period during the Thanksgiving holiday, according to CHP Officer Adam Garcia.

The official Thanksgiving holiday driving period begins Wednesday, Nov. 21 at 6 p.m. and continues through Sunday, Nov. 25. At the same time, the CHP will implement the Maximum Enforcement Period and put every available officer on the road.

Joining the thousands of CHP officers out on the road Thanksgiving week are millions of Californians, and crowded highways can often lead to frustrating moments at the wheel, CHP reported.

“Be prepared for traffic tie-ups, especially on the Wednesday before or the Sunday after Thanksgiving,” said Lt. Hayward.

In addition to busy roadways, inclement weather is another factor motorists may have to contend with. Rain, fog, wind and snow have been known to create not only frustrating, but hazardous conditions for drivers.

“Many crashes are caused by driving too fast for current conditions,” added Lt. Hayward.

Last year, during the Thanksgiving MEP, 42 people died in 4,768 collisions that occurred in California. More than half of the vehicle occupants killed were not wearing their seat belt.

Another sobering statistic: 1,670 people were arrested by CHP officers for driving under the influence last year over the Thanksgiving holiday; a nearly 10 percent increase from the same time period the previous year.

The Thanksgiving Maximum Enforcement Period also is an Operation CARE (Combined Accident Reduction Effort) holiday, Garcia reported.

Operation CARE is a joint program of the nation’s highway patrols that promotes safe driving on interstate highways during holiday periods, according to Garcia. CARE highways in California include Interstates 80, 40, 15 (San Bernardino to the Nevada border) and 5 (Bakersfield north to the Oregon line).

The Thanksgiving Maximum Enforcement Period will be one of the year's last. Garcia said every year CHP conducts the maximum enforcement operations on New Year's, Memorial Day, Independence Day, Labor Day, Thanksgiving and Christmas.

{mos_sb_discuss:2}

- Details

- Written by: Editor

LAKE COUNTY – Foreclosure rates around California continue to reach record levels, with foreclosures also continuing to climb in Lake County. {sidebar id=28}

A report released late last month by DataQuick Information Systems of La Jolla said that mortgage lenders started formal foreclosure proceedings on a record number of California homeowners in 2007's third quarter quarter, which resulted from declining home prices, sluggish sales and subprime mortgage distress.

A total of 72,571 Notices of Default – a notice given to a borrower that if they do not make payments by a certain deadline their property will be foreclosed on – were filed during the July-to-September period, according to DataQuick. That's up 34.5 percent from 53,943 during the previous quarter, and up 166.6 percent from 27,218 in third-quarter 2006.

Because a residence may be financed with multiple loans, last quarter's 72,751 default notices were recorded on 68,746 different residences, DataQuick reported.

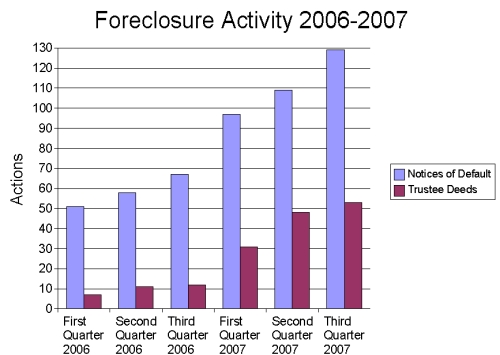

In Lake County, Notices of Default in the third quarter numbered 129, up 20 over the second quarter of this year and 92.5 percent higher than the third quarter of 2006, in which there were 67 Notices of Default.

“That would be a record,” said DataQuick spokesman Andrew LePage.

In Sonoma County, Notices of Default rose 224 percent from last year, with Trustee Deeds jumping more than 500 percent. For Napa County, Notices of Default were up 279 percent over last year, and Trustee Deeds were up 720 percent.

Statewide, recorded Trustees Deeds – which marks the actual loss of a home to foreclosure – totaled 24,209 during the third quarter, the highest number in DataQuick's statistics, which go back to 1988, LePage reported.

Last quarter was up 38.7 percent from 17,458 for the previous quarter, and up 604.8 percent from 3,435 for last year's third quarter, according to DataQuick. The peak of the prior foreclosure cycle was 15,418 in third-quarter 1996, while the low was 637 in the second quarter of 2005.

In Lake County, there were 53 Trustee Deeds in the third quarter, a 342-percent increase over the third quarter of 2006, in which there were 12 Trustee Deeds, said LePage. That's another record, as it's also up from the 48 Trustee Deeds in 2007's second quarter.

Since 1996, the average number of Trustee Deeds filed in a given quarter was 16, LePage said.

“As long as the Notice of Default number is increasing, you're likely to see an increase in the number of foreclosures,” LePage explained.

On primary mortgages statewide, homeowners were a median five months behind on their payments when the lender started the default process. The borrowers owed a median $10,914 on a median $344,000 mortgage.

"We know now, in emerging detail, that a lot of these loans shouldn't have been made,” said DataQuick President Marshall Prentice. “The issue is whether the real estate market and the economy will digest these over the next year or two, or if housing market distress will bring the economy to its knees. Right now, most California neighborhoods do not have much of a foreclosure problem. But where there is a problem, it's getting nasty.”

E-mail Elizabeth Larson at

{mos_sb_discuss:2}

- Details

- Written by: Elizabeth Larson

How to resolve AdBlock issue?

How to resolve AdBlock issue?