Business News

- Details

- Written by: Redwood Credit Union

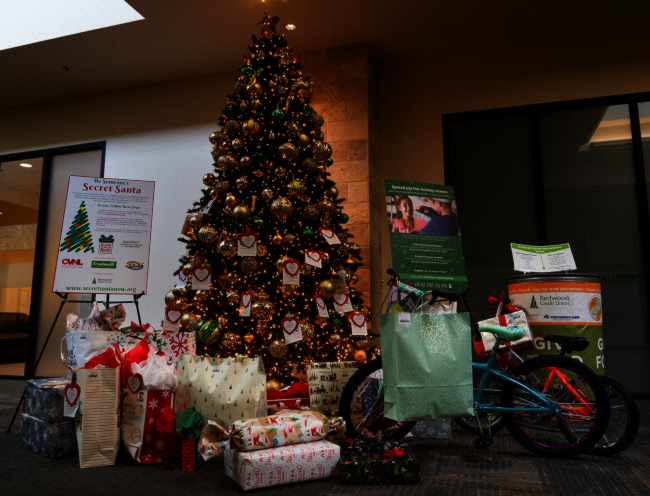

LAKE COUNTY, Calif. — Redwood Credit Union, or RCU, invites the community to give back this holiday season through its annual gift drive and a new porch-to-pantry food drive.

RCU has partnered with a nonprofit startup to launch an innovative model that makes it simple for anyone to make a difference. The program allows North Bay and San Francisco residents to donate food directly from their doorstep.

Porch-to-pantry food drive

Community members can sign up to donate at any RCU branch or online at this link.

On Saturday, Dec. 13, volunteers will pick up the shelf-stable foods from donors’ homes and deliver them to local food banks and pantries.

Gift drives

In addition, RCU’s 22 branches and RCU Auto Services are accepting gift items through mid-December for holiday distribution by local nonprofit agencies. The following is where to donate and the local organizations that will benefit. To find a branch near you, click here.

Lake County branch

Drop off a new, unwrapped gift at the RCU Lower Lake branch through Dec. 12 to support children in Lake County through Toys for Tots.

Last year, RCU distributed 947 gifts and collected 3,126 pounds of food — enough for 3,751 meals.

Building on last year’s success, RCU hopes to provide even more gifts and meals to North Bay and San Francisco communities this holiday season.

For more information, visit www.redwoodcu.org/holidaygiving.

- Details

- Written by: Elizabeth Larson

SANTA ROSA, Calif. — Redwood Credit Union members have collectively saved more than $1.5 million in just eight months thanks to a suite of new financial tools and services designed to promote financial resilience and long-term stability.

Earlier this year, Redwood Credit Union, or RCU, introduced two automated savings tools, Simple Save and Round Up & Save, alongside a new Certified Financial Coaching program, offered at no cost to members.

These initiatives aim to make saving more accessible and to provide personalized guidance for financial planning.

Having inadequate savings can result in a lack of financial stability, security, and opportunities for long-term growth. The standard budgeting advice of setting aside 3 to 6 months of expenses for emergencies doesn’t work for many people.

Most Northern California residents live paycheck to paycheck and struggle with ways to start saving money. RCU provides members with ways to save that are easy, repeatable, realistic, and attainable. This includes helping those who need it to get started with smaller, manageable steps before graduating to bigger steps.

According to RCU, 72% of members have savings of over $500 which is 4% higher than national average of 68%. The credit union attributes this progress to its focus on meeting members where they are and helping them build savings incrementally.

“We want our members to be as financially resilient as possible,” said Brett Martinez, president and CEO of RCU. “Whether it’s preparing for a natural disaster, a family emergency, or back-to-school expenses, our goal is to help our communities stand strong financially.”

Simple Save, launched in April, automatically transfers a selected percentage of new checking deposits into savings. Round Up & Save, introduced in January, rounds up debit card purchases and transfers the difference into savings.

Together, these tools demonstrate how RCU’s commitment to innovative solutions deepens social impact while helping members build financial wellness.

One RCU member recently reported that using both Simple Save and Round Up & Save helped them easily save $15 to $20 per week, which has quickly added up to more than $300 in their savings account.

“I could have really used this type of savings tool ahead of unexpectedly having to replace my car’s alternator last year,” said the RCU member.

In addition to the new savings tools, RCU’s Certified Financial Coaching program provides free, confidential support in setting financial goals and learning to reach them by budgeting, saving, debt repayment, and credit building.

The program is supported by over 80 RCU team members, all certified through the Financial Counseling Certification Program, or FiCEP, offered by America’s Credit Unions. Financial Coaching appointments are available by video call or in person at any of RCU’s 22 branches, and can be scheduled online.

“Our financial coaches often hear that members feel more confident and less stressed after talking through their financial situation,” said Jose Alvarez, regional VP of member experience at RCU. “These conversations empower our members, offering real solutions and personal support to turn financial dreams into achievable goals.”

RCU serves eight counties across the North Bay and San Francisco and continues to invest in programs that advance the financial well-being of its members and communities.

- Details

- Written by: Redwood Credit Union

LAKE COUNTY, Calif. — Redwood Credit Union’s recently launched Benefits Checking isn’t just a checking account — it’s a comprehensive protection package that offers peace of mind in moments people need it most.

It’s added protection when your child has a fever in the middle of the night, you get a flat tire, or you drop your phone. It’s there when you need help rebuilding your credit, or someone you don’t know attempts to open an account in your name.

Whether it’s a shattered phone screen, sudden health concerns, identity theft, or unexpected vehicle breakdowns, Benefits Checking is smart coverage at a time when every dollar counts.

“I had a member who I noticed was paying $19.95 a month for Equifax credit file monitoring. They were able to cancel that and now only pay $7 a month for our credit file monitoring, plus all of the other benefits!” said Nicole Munns, an RCU member relationship specialist. “And my roommate and I were able to cancel the insurance on our phones through our shared cell phone carrier, which will save us hundreds of dollars a year.”

There are travel and leisure discounts too — early members have reported using Benefits Checking for everything from getting a free root beer float to saving hundreds on a rental car.

“Benefits Checking embodies RCU’s commitment to its purpose by providing a consumer checking product that delivers real solutions to everyday challenges,” said Stephen Nixon, vice president of Deposits.

Among the services Benefits Checking offers:

• Cell phone protection: With Benefits Checking, Members are covered up to $600 per damage or loss claim, twice yearly. This benefit covers up to four phones on a cell phone bill that is paid through the Benefits Checking account or through a credit card issued by RCU, with a $50 deductible.

• Identity and credit monitoring: The included identity theft monitoring reviews over 1,000 databases, the dark web, and public records to identify suspicious activity. In the event of an identity theft, members are connected with dedicated specialists who know exactly how to help. • Also included: $25,000 in identity fraud reimbursement coverage and IDProtect Score Tracker and a credit Score simulator, which will provide insights into how different financial actions may impact their credit score.

• Telehealth services: Through DocTegrity, members can connect with board-certified doctors and licensed therapists without leaving home and without a copay. An enrolled spouse and up to 6 dependent children above 2 years old are also eligible for services at no additional cost.

• Roadside Assistance: A 24/7 phone support line if a motorist is stranded with a flat tire, dead battery, or an empty gas tank. And there’s coverage up to $100 per occurrence, twice per year.

• Travel and Leisure: As an extra bonus, members can enjoy travel, dining and shopping discounts year-round.

All of these benefits can be accessed directly through a secure portal provided in digital banking.

Founded in 1950, Redwood Credit Union is a full-service, not-for-profit financial institution providing personal and business banking to consumers and businesses in the North Bay and San Francisco.

With a mission to passionately serve the best interests of its members, team members and communities, RCU delivers many ways for its members to save and build money through checking and savings accounts, auto and home loans, credit cards, digital banking, business services, commercial and SBA lending, and more.

For more information, call 800-479-7928, visit redwoodcu.org, or follow RCU on Facebook, Instagram, X and LinkedIn for news and updates.

- Details

- Written by: AAA

A recent refinery issue has caused a surge in gas prices ahead of Labor Day weekend.

The national average for a gallon of regular went up more than seven cents this past week to $3.21 mainly due to flooding at BP Whiting Refinery in Indiana.

The largest refinery in the Midwest shut down operations for several days following a severe thunderstorm. As a result, states in the Great Lakes region saw an increase in gas prices, but they may get some relief soon now that the refinery is back online.

“Overall, summer gas prices have remained steady and should trend downward as the fall season begins,” says Doug Johnson, spokesperson with AAA Mountain West Group. “The incident in Indiana underscores the futility of predicting gas prices. Mother Nature and geopolitical events can suddenly and unexpectedly impact fuel prices.”

California drivers will find an average price of $4.59, a 10-cent jump from last week.

Fuel prices around the state:

• Lake County: $4.52.

• San Francisco: $4.71.

• Oakland: $4.63.

• San Jose: $4.57.

• Sacramento: $4.54.

• Fresno: $4.59.

• Stockton: $4.48.

According to new data from the Energy Information Administration, or EIA, gasoline demand increased from 8.84 million b/d last week to 9.24 million.

Total domestic gasoline supply decreased from 223.6 million barrels to 222.3. Gasoline production increased last week, averaging 10 million barrels per day.

Oil market dynamics

At the close of Wednesday’s formal trading session, WTI rose 90 cents to settle at $64.15 a barrel. The EIA reports crude oil inventories decreased by 2.4 million barrels from the previous week. At 418.3 million barrels, U.S. crude oil inventories are about 6% below the five-year average for this time of year.

EV charging

The national average per kilowatt hour of electricity at a public EV charging station stayed the same this past week at 36 cents. In California, it’s 37 cents.

State stats: Gas

The nation’s top 10 most expensive gasoline markets are California ($4.59), Hawaii ($4.47), Washington ($4.39), Oregon ($3.97), Nevada ($3.81), Alaska ($3.75), Illinois ($3.54), Idaho ($3.48), Arizona ($3.42), and Michigan ($3.37).

The nation's top 10 least expensive gasoline markets are Mississippi ($2.73), Arkansas ($2.78), Louisiana ($2.78), Oklahoma ($2.78), Tennessee ($2.79), Texas ($2.80), Alabama ($2.83), South Carolina ($2.84), Missouri ($2.87), and Kansas ($2.87).

State stats: Electric

The nation’s top 10 most expensive states for public charging per kilowatt hour are Alaska (51 cents), West Virginia (49 cents), Hawaii (47 cents), South Carolina (45 cents), New Hampshire (43 cents), Tennessee (43 cents), Arkansas (42 cents), Montana (42 cents), Idaho (42 cents), and Louisiana (42 cents).

The nation’s top 10 least expensive states for public charging per kilowatt hour are Kansas (25 cents), Missouri (27 cents), Maryland (28 cents), Utah (28 cents), Nebraska (30 cents), Delaware (31 cents), Vermont (32 cents), North Carolina (32 cents), Washington (33 cents), and Virginia (33 cents).

Drivers can find current gas and electric charging prices along their route using the AAA Mobile App, now available on CarPlay.

Fine current fuel prices at GasPrices.AAA.com.

How to resolve AdBlock issue?

How to resolve AdBlock issue?