Business News

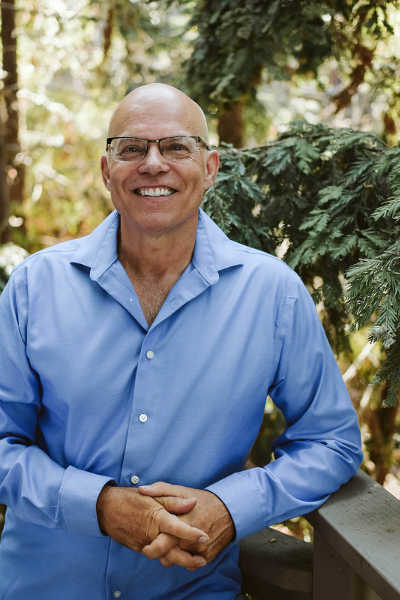

LAKE COUNTY, Calif. – Malcolm Dunshee, retired home builder and former general contractor, has joined Realty 360 Wine Country.

Mary Benson, broker of the Lower Lake realty firm, said, “I am so happy that Malcolm has joined us. His experience in home construction adds a valuable dimension for our clients.”

Dunshee got his general contractor’s license in 1984, and was a home builder and remodeler in Lake County for many years before going into the wholesale cabinetry business during the economic downturn.

“My contacts in the cabinetry business can get you a free CAD (Computer Assisted Design) kitchen remodel,” Dunshee explained. “When I look at homes with clients, I am looking at the construction, the finishes, the overall quality of the house. Sometimes I can suggest a simple change to transform a room. I have seen kitchens that just don’t work well, and just moving a doorway can create more counter and cabinet space.”

Dunshee continued, “With CAD, we can change the layout of your kitchen, over and over, until we get the optimal layout.”

“When we work for you, we only have 1 job,” Benson said. “If you are listing your home, we are working to get you as much money as possible. If you are buying a home, we are working to get you to pay as little as possible. For this reason, we will not represent both buyer and seller in the same deal. We work for you, and for you alone.”

Mary Benson worked as a mortgage broker for 10 years at Day Mortgage in Lower Lake before specializing in selling real estate in 2014.

- Details

- Written by: Elizabeth Larson

SAN DIEGO – At a launch event in San Diego on Tuesday, in front of small business leaders, community partners, and Californians ready to take control of their retirement security, California State Treasurer John Chiang and State Assemblymember Lorena Gonzalez kicked off CalSavers, a new statewide retirement savings program destined to empower 7.5 million California workers, currently without access to a workplace retirement program, to start saving for their golden years.

“Our businesses and workers have grown California’s economy to the fifth largest in the world, so it is with great fulfillment that we, as one state, are today declaring we are leaving no worker behind to languish in poverty through their golden years,” said Treasurer Chiang. “Small business employees and our state’s millions of self-employed and gig economy workers now have a clear path to saving for a secure retirement. CalSavers will help facilitate the most ambitious and sweeping expansion of retirement security since the passage of Social Security in 1935.”

California is a leader in the growing national movement to provide retirement savings programs to workers who lack access through their places of work. Illinois and Oregon have created similar savings programs for workers, and a growing list of additional states are waiting in the wings to follow California’s example, and similarly revolutionize efforts to ensure workers do not retire into poverty.

Senator Kevin De León, who authored the groundbreaking legislation that created CalSavers, added, “No one who works every day to provide for themselves and their loved ones should be forced to retire into poverty. That’s why we fought Wall Street to create CalSavers, which will provide millions of Californians with a way to end their working years with dignity.”

California currently has nearly two-hundred thousand small businesses that are unable or unwilling to offer their employees a retirement savings program, resulting in four million small business employees working without any workplace retirement.

“CalSavers could be the difference between retiring with dignity and some level of independence or having to rely heavily on social services when you’re in your golden years,” said Assemblymember Gonzalez. “I’m pleased about the process we are making to allow working Californians to build toward a secure retirement through CalSavers.”

In San Diego County, more than 16,000 employers and more than 338,000 employees are eligible for the retirement savings program.

Tuesday’s event is one of five being held statewide this week to launch the CalSavers program; the others being held in Los Angeles, Fresno, Sacramento and San Francisco.

Experts agree that the critical mistake many workers, of all ages, make year-after-year lies in assuming Social Security benefits will manage to sustain them in their retirement years. But, with the average Social Security benefit paying less than $17,000 annually, Social Security alone is not enough to retire with dignity.

In fact, nearly half of California workers are on a trajectory to retire into economic hardship, defined as below twice the federal poverty rate. And with researchers now estimating that California’s senior population is projected to increase by 64 percent by 2025, that means up to 12 million Californians may be at risk of retiring without the resources to live a dignified retirement.

But access to workplace retirement programs makes individuals 15 times more likely to save for retirement, and even modest savings faithfully maintained over a career can make a difference. Analyses have shown a typical 25-year-old California worker who participates in CalSavers could amass $350,000 by the time they retired at age 65 — two-thirds of which would come from earnings on the original investments made by the saver.

CalSavers will put more Californians on the path to greater financial independence in retirement without spending a cent of taxpayer monies. Additionally, there are no costs to employers, who are already registering to participate in the pilot program.

“Registering was easy and the platform was very user friendly and easy to navigate,” said Victor Barajas, human resources manager at San Diego-based Integrated Microwave Corporation, one of the pilot employers already registered for CalSavers.

The law establishing CalSavers requires any employer with five or more employees, which does not already offer a workplace retirement savings program, to begin offering a retirement savings program either through the private market or by providing their employees access to CalSavers. Beginning July 1, 2019, employers of all sizes can register for CalSavers at www.CalSavers.com.

However, employers can currently register for the pilot program already underway. Employers with 100 or more employees, who do not already offer a retirement plan, will have until June 30, 2020 to register. Employers with 50 or more employees will be required to register by June 30, 2021, and those with five or more employees thereby June 30, 2022. Employers of any size can register at any time, even before their registration deadline.

Once enrolled, employees can choose their own contribution amount, up to the federal maximum of $6,000 – the same as any Individual Retirement Account, or IRA – with deductions made automatically from their paychecks.

For more information about CalSavers or to enroll in the program, employers or individuals can visit www.CalSavers.com, email

- Details

- Written by: California Treasurer's Office

- Residential policy locator service helps wildfire survivors and family members locate insurance policies

- Legislature’s Wine and Governmental Organization Committees plan Nov. 29 hearing

- Fisheries hearing in San Francisco next week focused on whale protection efforts and state of the state on latest crab season

How to resolve AdBlock issue?

How to resolve AdBlock issue?