News

- Details

- Written by: Lake County News Reports

MIDDLETOWN – An Elk Creek man died Saturday as the result of a motorcycle collision.

Tracy Griffin, 35, was the victim of the fatal crash, which occurred at 3 p.m. Saturday on Butts Canyon Road, according to CHP Officer Steve Tanguay.

Griffin was riding his 2003 Suzuki GSXR1000 motorcycle behind a small group of motorcycle riders on Butts Canyon Road heading toward Middletown from the Napa-Lake County line when he failed to negotiate a left curve and went off of the roadway, Tanguay reported.

Tanguay said Griffin's motorcycle struck the guard rail, which caused Griffin to be thrown from the motorcycle.

Griffin sustained fatal injuries as a result of this collision and was pronounced deceased at the scene, Tanguay said.

When Griffin didn't show up at the meeting point with the group of motorcyclists, they went back to look for him. Tanguay said they found Griffin where the collision occurred.

Tanguay said that CHP Officer Rob Hearn is investigating the collision.

{mos_sb_discuss:2}

- Details

- Written by: Jon Meyer

Before I return to my discussion of the Alternative Minimum Tax, a couple of important notes.

There is a scam email being sent to individuals targeting those who either did not receive a stimulus payment or felt they deserved a larger payment. This email, which looks official, urges taxpayers to respond by downloading information that will allow them to receive additional money. The IRS simply does not send out emails. So if you receive such an email, it is bogus.

The stimulus rebate received last year, which were based on 2007 income was actually advance refunds of amounts from one's 2008 return. If you didn’t get the full rebate of $600 or $300 for those with lower income or dependents, the IRS will calculate the rebate again based on 2008 data. If the recalculated rebate is larger than what was received last year, you will receive the difference. If the recalculated rebate is the same as last year's, or less, you do not have to pay it back. On most tax software there is a place to report what you actually received as a stimulus rebate.

In addition, while many people were getting ready for the holidays last December, there was a bill passed that effects the tax return preparation for the 2009 tax year.

The Worker, Retiree and Employer Recovery Act of 2008 was approved on Dec. 11, 2008. This act deals primarily with pensions, however under this act there is an important section that deals with retired individuals receiving Required Minimum Distributions (RMD). These are amounts which, in general, must be withdrawn from certain qualified pension plans once a taxpayer reaches the age of 70 ½ years of age.

In general, the penalty or excise tax applied when the RMD has not been taken has been eliminated for the tax year 2009, thus the RMD need not be withdrawn in 2009. This may benefit those who are taking withdrawals from their retirement account by not forcing withdrawals of retirement accounts that are dropping in value. By allowing the principal to remain in the account longer, it is hoped that a recovery will increase the value to the account.

In the last article I mentioned how new legislation could make one's 2009 tax return potentially painful; well I was speaking of what was happening at the time. Both the House Ways and Means and Senate Finance committees have since announced that they are working on new tax legislation. These new potential laws will most likely add a layer of complexity to the existing law. The Senate promises $275 billion and the house promises $30 billion worth of change. These implied promises sound very good, but what will the reality bring?

When judging tax legislation, one must remember that there will be a heck of a lot of speeches and posturing until we really see the reality. So far, none of the analysis of the proposals seems exciting or likely to bring large tax refunds. There will most likely be a continuation of promises and a lot of politics before we actually see workable proposals.

Many of the proposals made will never see the light of day; one such proposal is the “Rangel Rule,” named after the chair of the House Ways and Means Committee. This powerful congressional committee is where all income tax bills get their start, as well as most governmental spending begins. Other committees may propose changes, but all the changes come from this committee. Lake County should be proud that our congressional representative Mike Thompson is a member of this committee.

This rule states that the IRS cannot charge interest or penalties on the collection of past income tax owed. It turns out that the honorable Mr. Rangel paid $5,000 in past taxes he owed but refused to pay any interest or penalties on those taxes. While this is one of my favorite proposals, I seriously doubt that it will see the light of day.

This process makes it crucial that we all be aware of the upcoming changes and determine what, if any, these changes will have on our tax or financial position. This does not mean shifting through all the politics and reports, just that when the final bill is signed that you know the important elements and that you decide if you need to adjust your strategy.

It appears that the Alternative Minimum Tax will not be ignored and will be patched as usual instead of being permanently corrected. The patch, in this case, is a temporarily increase in the exemption level. This tact was probably taken because had it not been proposed, then 20-30 million taxpayers hit with an increase in their tax bill would create a protest too big to ignore.

This of course means that one should have a strategy. As I mentioned in my last article, the days when one could just ignore their tax and financial position has ended. We must be aware how changes in law and finances affect our position.

Of course, a detailed strategy in regard to the AMT must be individualized, but in general, it means, to review your tax return after it has been filed and projecting or estimating what will happen this year and over the next few years.

If you are expecting major changes such as retirement or having children or if there is a potential for higher taxes due to the AMT or less deductions or just more income, then measures should be taken to reverse these effects. This can mean a variety of strategies that in general involve the timing of receiving or paying income and expenses. There may be other tactics that can be taken. The time to act is now, while there is time to plan.

Of course, it’s hard to know what’s going to happen in the future and at this time, it may not be possible. However, once we get into the habit of planning and doing periodic reviews, then when you spot a change, action can be taken before a huge tax bill comes your way.

Jon Meyer is a local tax accountant and enrolled agent with more than 25 years experience in tax preparation. The office of Jon the “Tax Man Meyer “also offers retirement planning and insurance options. Questions regarding this article can be made by calling 928-5200.

{mos_sb_discuss:2}

- Details

- Written by: Elizabeth Larson

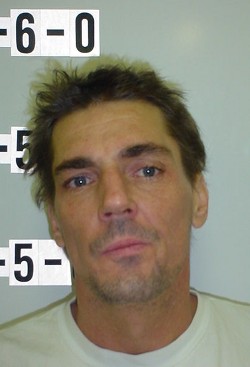

KELSEYVILLE – A Kelseyville man is in custody for allegedly murdering his roommate.

John Robert Gray, 43, was arrested at 4:30 p.m. Saturday by sheriff's officials, who had begun looking for him earlier in the day.

The murder victim is 37-year-old Eric Joaquin, who was reportedly beaten to death, according to one neighbor who spoke with sheriff's deputies.

Lake County Sheriff's officials did not respond to weekend calls or e-mail regarding the incident.

Several neighbors spoke with Lake County News, but asked not to be identified for reasons that included fear of retaliation from some of the subjects who had frequented the home.

On Saturday morning at 9:42 a.m. sheriff's dispatch put out a call to sheriff's deputies about an incident at Gray's home at 10163 Del Monte Way in the Clear Lake Riviera, based on a 911 call that appeared to have been made from the address. The original report indicated the victim may have been shot, according to radio reports.

There, law enforcement reportedly found Joaquin's body inside the house. The street was then cordoned off as deputies began interviewing neighbors.

One of the neighbors, who called the situation “a nightmare,” added, “Whoever did this is a scary person.”

All of the neighbors said sheriff's officials confirmed to them that a homicide had taken place. One man said he was told Gray was the suspect and Joaquin the victim, and that they believed Joaquin had died sometime late Friday night or early Saturday morning.

Joaquin had moved into the house with Gray within the last three to four months, according to one neighbor. That man also reported seeing Gray and Joaquin working together on a project car at the house.

The neighbors reported not hearing anything on Friday night, and one man said he had not seen Gray in several days, a circumstance he called “kind of weird.”

“In the last few days it's been kind of quiet over there,” the man said.

Gray was not arrested at his home, the man added.

One of the neighbors reported sharing hellos and occasional friendly waves with Gray and Joaquin, but he had been concerned about constant comings and goings of others who had been visiting the house at all hours, raising concerns about possible drug activity.

Over the last month and a half the house had been visited by the sheriff's office four times, said a neighbor, including once on Feb. 22, according to a sheriff's log entry. One of the neighbors said he guessed they must have had a scanner in the house; shortly before sheriff's deputies arrived on the Feb. 22 visit, several people came running outside and appeared to be hiding things.

Sheriff's deputies were called back to the Del Monte Way address on Sunday on the report of people taking property out of the home.

Gray, whose booking sheet lists him as being self-employed, is being held in the Lake County Jail on $500,000 bail. Jail records indicate that he's due to appear in court on Tuesday in Department 2.

Harold LaBonte contributed to this report.

E-mail Elizabeth Larson at

{mos_sb_discuss:2}

- Details

- Written by: Lake County News Reports

SACRAMENTO – Pet owners around the state won't have to pay a new tax when taking their animals for veterinary care.

The California Veterinary Medical Association (CVMA) and The Humane Society of the United States have thanked Gov. Arnold Schwarzenegger and the California Legislature for responding to the public's opposition to a tax on veterinary care.

The 17-month budget passed late last month by the state Legislature did not include the governor's earlier proposal to broaden the sales and use tax to include veterinary services, a proposal Lake County News has reported on in January.

Leaders of the two organizations that work on behalf of animals and those who care for them expressed their appreciation for the final outcome regarding taxation of veterinary services in the budget bill.

“Requiring pet owners to pay a tax to care for their animals is bad public policy,” said William Grant, II, DVM, president of the CVMA. “We are pleased members of the 'Big Five', including the governor, recognized that and the proposed tax was removed from the final budget bill.”

“On behalf of our 1.3 million California constituents, we are very grateful to California's leaders for recognizing the financial injury associated with the proposed Fido Fine,” said Sacramento-based Jennifer Fearing, chief economist for The HSUS. “This tax would almost certainly have resulted in less medical care for animals and more dogs and cats landing in animal shelters. It was a flawed idea that would've been a step backward in the otherwise progressive trajectory toward more humane treatment of animals in our state.”

Thousands of Californians called an automated phone number established by the governor's office to allow residents to express their support or opposition for the governor's proposal to tax veterinary services.

"The opposition of veterinarians, pet owners and concerned citizens was so intense, a special extension was added to the governor's budget voice mail line to handle the opposition to the tax on pets," Grant said. "We believe the overwhelming number of calls delivered an emphatic message to the governor that taxing pet owners would be hugely unpopular and inequitable."

The budget proposal to extend the sales tax to veterinary services could have added up to 10 percent to the cost of caring for animals in California, according to the state Legislative Analyst's office. This would endanger the health and well-being of animals kept as pets, raised on farms, or sheltered by humane agencies.

Agreeing with one of CVMA's arguments against the proposal, the California Legislative Analyst's Office noted the tax on veterinary services "would create inequities in the tax structure by taxing some services while leaving other similar services untaxed."

"We know the fight to protect animal care from taxation is not over," emphasized Grant. "Our membership remains firmly opposed to taxes that will force our clients to make untenable decisions affecting the quality of life for their pets and that might put our food supply at risk.”

{mos_sb_discuss:3}

How to resolve AdBlock issue?

How to resolve AdBlock issue?