Unionized staff at Sutter Lakeside, seven other hospitals vote to strike

LAKE COUNTY, Calif. — The union representing staff at eight different Sutter hospitals and medical centers across Northern California — including Sutter Lakeside in Lakeport — said frontline health care workers in those facilities have voted to strike.

SEIU-United Healthcare Workers West, or SEIU-UHW, issued a statement on Friday evening regarding the strike vote.

“The workers overwhelmingly approved the strike with a 96% vote in support, citing bad faith bargaining by Sutter executives,” the union reported. “Workers have not yet chosen dates and will continue trying to bargain with Sutter executives at upcoming sessions on October 9 and 10.”

Union member health care workers at Sutter Health facilities in Oakland, Santa Rosa, Roseville, Berkeley, Lakeport, Vallejo, Antioch, Castro Valley and San Francisco were involved in the vote.

The union said the strike votes apply to job classes including nursing assistants, respiratory therapists, licensed vocational nurses, environmental services, cooks and technicians.

Lake County News was not immediately able to reach Sutter Lakeside on Friday night for comment on the potential strike.

In August and September, SEIU-UHW members in Lakeport and the seven other hospitals slated for strike held a series of rolling pickets, including a march and rally at Sutter Health’s Sacramento Medical Center that the union said “drew over 1,000 frontline healthcare workers calling for safer staffing, fair pay, and investment in underserved communities across the giant healthcare system.”

At the time of the Aug. 12 picket in Lakeport — the first such action at the hospital in over three years — Sutter officials told Lake County News that the union had announced pickets after just one week of bargaining.

“While we respect the right to demonstrate, these pickets are not impacting patient care. Our hospitals and clinics remain open and fully operational, and we continue to provide safe, high-quality care to the communities we serve. We remain focused on reaching a fair agreement through continued collaboration at the bargaining table,” the hospital’s August statement said.

On Friday, the union statement on the anticipated strike included a statement from union member Nikki Moorer of Sutter Solano.

“We don’t want to go on strike, but we feel like we have to,” said Moorer. “We need management to stop bargaining in bad faith and listen to us to fix working conditions and short staffing. Procedures get canceled, and patients are sent home because there aren’t enough staff to properly stock the equipment we need. That’s not care. That’s a crisis.”

The union workers supporting the strike vote said that Sutter’s management has refused to invest in the staff who make that mission possible.

“Turnover has forced employees to take on multiple roles and work longer hours as experienced caregivers leave for higher-paying jobs. Staffing shortages are stretching the remaining workforce thin and putting patient care at risk. Despite this, Sutter executives refuse to listen to frontline healthcare workers to negotiate for a contract to help solve these problems,” the union statement said.

The union has faulted Sutter for the pay amounts of its top executives, including Sutter Health CEO Warner Thomas, who earned over $11 million in 2023. They’ve accused Thomas of refusing to invest in staffing and patient care.

Email Elizabeth Larson at

CHP adds strength to ranks with largest graduating class in nearly 16 years

In the largest graduation since December 2009, the California Highway Patrol on Friday welcomed 146 new officers, underscoring the Department’s enduring commitment to public safety and public service in California.

After 26 weeks of rigorous training at the CHP Academy in West Sacramento, these newly sworn officers are prepared to carry forward the CHP’s mission of Safety, Service and Security, which not only strengthens the department today but also builds a stronger foundation for the generations of officers to come.

“Today’s graduates embody the heart of service and sacrifice that defines our profession. These men and women have chosen the path of dedication to others, and we are proud to welcome them into the ranks of law enforcement as they begin their journey to protect and serve California’s communities with integrity and compassion,” said Commissioner Sean Duryee.

These new officers will now report to one of the CHP’s 102 Area offices across California to start their law enforcement careers, protecting and serving communities throughout the state's 58 counties.

The graduates bring a broad range of skills and experiences to the department, reflecting their diverse backgrounds. Among them are former college athletes, military veterans and correctional officers, as well as others with prior public safety experience.

During academy training, cadets receive instruction in traffic enforcement, crash investigation, defensive tactics, firearms, emergency vehicle operations and community policing.

The curriculum also focuses on legal responsibilities, communication, ethics and cultural awareness to prepare cadets to serve California’s diverse population.

Following Friday’s graduation ceremony, nearly 300 cadets remain at the CHP’s live-in training facility, and an additional 160 cadets are set to start instruction on Oct. 13 as part of the department’s ongoing efforts to enhance public safety across the state.

The CHP continues to actively recruit dedicated individuals who are ready to make a difference in communities throughout California. A career with the CHP offers comprehensive training, competitive benefits and opportunities for professional growth and advancement.

To learn more about joining the CHP, please visit www.CHPMadeForMore.com to take the first step towards a rewarding career in law enforcement.

California Department of Fish and Wildlife finalizes State Wildlife Action Plan 2025

The California Department of Fish and Wildlife, or CDFW, has announced the State Wildlife Action Plan 2025 update is complete.

It can be found at the CDFW State Wildlife Action Plan, or SWAP, web page.

California’s SWAP, which is mandated by Congress and updated at least every 10 years, provides a comprehensive wildlife conservation strategy that is achieved through various conservation projects executed statewide.

Public and tribal input significantly shaped the plan. In March 2025, the SWAP Team held two public webinars, four conservation partner meetings, and two inter-tribal listening sessions.

In conjunction with these meetings, a public draft review generated over 160 comments from nearly 20 organizations, tribes, and the public.

Since 2005, CDFW and partners have implemented SWAP conservation strategies with funding support from the U.S. Fish and Wildlife’s State Wildlife Grant, or SWG, program, which has awarded CDFW with nearly $71 million since 2000. This year marks the SWG program’s 25th anniversary.

CDFW uses SWG funds to develop and implement its SWAP and to support wildlife conservation projects across the state.

Funded projects must support strategies outlined under SWAP, whether it’s to benefit a species or to implement a SWAP goal or conservation strategy.

This funding is critical to species that aren’t protected and non-game species that often lack adequate funding sources.

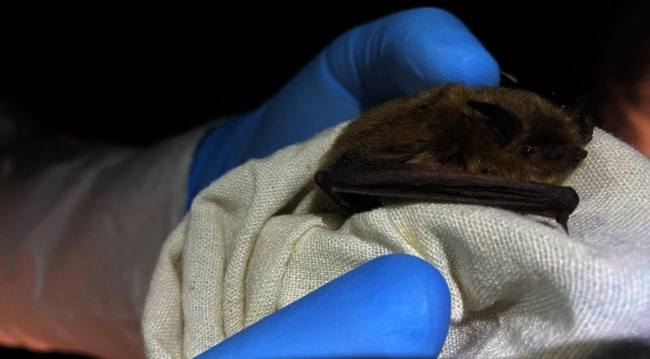

Conservation efforts benefitting from SWAP and SWG funding include the White-Nose Syndrome Response Project, established to monitor California’s bat population for the deadly disease that could wipe out entire colonies of these small mammals; bats play a critical role in protecting agricultural lands from pests.

Another SWG funded project has successfully established a new population of Unarmored Threespine Stickleback fish in Southern California; this unique species’ range has been significantly reduced due to human development. These and other conservation highlights can be found on CDFW’s SWAP web page.

At its heart, SWAP is a non-regulatory blueprint to conserve California’s fish and wildlife, and their habitats. It combines the latest science and conservation priorities with recommended actions and tools.

SWAP 2025 includes updated information on the current health of California’s fish, wildlife and plant resources.

Explore SWAP 2025 to learn about CDFW’s conservation tools, as well as habitat and wildlife monitoring efforts.

Questions about SWAP can be directed to the CDFW SWAP Team at

Estate Planning: Inherited assets and estate planning by married people

Assets that are inherited by a married person are separate property (i.e., owned and controlled by the inheriting spouse alone) unless it is commingled (e.g., money deposited into a joint account) or re-titled (e.g., real property) to include the married person’s spouse.

If so, the other spouse can acquire a community property or separate property interest in the inherited separate property asset. Such inherited assets may be a difficult issue when a married couple does estate planning.

Most married people do a single joint living trust into which they transfer their real property and non retirement investment accounts, especially the assets that they acquired together from marital earnings. Often that means the surviving spouse inherits all, or almost all, the deceased spouse’s share of the trust estate.

However, a married person’s inherited assets may require an exception, especially when the asset is co-owned with siblings (or other family) or when the married person has their own children from a prior marriage.

Inherited assets co-owned by siblings may be excluded by the siblings when doing their joint estate planning with their spouses. That is, the siblings themselves may either expect or agree to keep their own undivided share in co-owned inherited property exclusively within the family bloodline (i.e., excluding their spouses and any step children).

Consider siblings who inherit co-ownership in a family real estate or a family business. Such assets are regarded by the siblings as special assets for personal or economic reasons. The siblings may agree that such assets stay in their family bloodline. Perhaps each sibling does the necessary estate planning to ensure the outcome. Alternatively one or more siblings may be undecided and do nothing. Indecision can lead to unintended outcomes.

Consider the sibling who keeps an undivided fractional ownership interest in real property outside of their joint husband and wife living trust. The sibling’s accompanying will may likely leave everything outside the trust (excluding any retirement and bank accounts that pass automatically to death beneficiaries) to the couple’s joint trust. If so, the surviving spouse may have to probate the deceased spouse’s will to claim the real property interest, thus partly defeating the benefit of their probate avoidance joint living trust.

Moreover, the deceased sibling’s share may now perhaps, depending on the trust’s provisions, go to their surviving spouse who may then co-own the special assets with in-laws; thus also undoing the siblings’ agreement. Alternatively, a sibling may do no estate planning at all, in which case their surviving spouse and children jointly inherit their separate property assets, perhaps by probate.

If a married person has separate children whom they did not raise as minors, they often want their own children (and not step children) to inherit separate property, including inheritances, that they did not purchase with their spouse. That may entail the married person establishing a separate property trust to exclude their spouse from inheriting or controlling such assets. The separate property trust may provide possible lifetime benefits to the surviving spouse and either immediate or eventual distribution to the children, as drafted.

Alternatively, the assets may be included within the joint trust as the contributing spouse’s separate property assets. Such assets may pass at the contributing spouse’s death to that spouse’s own children (bypassing the surviving spouse), may be distributed to the children (of the contributing spouse) subject to a life estate for the surviving spouse, or else may be held in further trust for the lifetime benefit of the surviving spouse, with distribution to the children at her death.

What outcome is attained depends on whether or not appropriate estate planning and proper administration of the estate planning occur. The estate planning must be drafted in contemplation of what its eventual administration will require and mean at that time for those concerned.

The foregoing discussion is not legal advice.

Dennis A. Fordham, attorney, is a State Bar-Certified Specialist in estate planning, probate and trust law. His office is at 870 S. Main St., Lakeport, Calif. He can be reached at

How to resolve AdBlock issue?

How to resolve AdBlock issue?