Business News

- Details

- Written by: Lincoln-Leavitt Insurance

LAKEPORT, Calif. — Lincoln-Leavitt Insurance recently received the Agency Excellence Award at the Leavitt Group Partners Conference in Las Vegas, Nevada.

This annual conference, which includes Leavitt Group’s network of agencies from over 250 locations nationwide, serves as a platform for industry leaders to connect, share insights, and celebrate excellence.

“We are honored to receive this award and thank our valued clients for allowing us to service all their insurance needs,” said Jill Jensen, agency co-owner of Lincoln-Leavitt Insurance.

When presenting the award, Leavitt Group commended Lincoln-Leavitt Insurance for its outstanding performance across key areas of business.

The Agency Excellence Award is given to only a few agencies who achieve top industry sales, service, and financial performance metrics.

Leavitt Group is one of the largest privately held insurance brokerages in the nation with a mission to build, serve, and perpetuate independent insurance agencies as partners with local co-owners.

To learn more about Lincoln-Leavitt Insurance, visit www.leavitt.com/lincoln.

- Details

- Written by: Editor

NICE, Calif. — The North Shore Business Association will hold a mixer and dinner on Wednesday, June 25.

The event will take place at the Nice Event Center, located at 2817 E. Highway 20, beginning with the mixer and mingling at 5:30 p.m.

Vision of Hope Village will host the dinner and mix, which costs $25 per person.

Dinner will begin at 6 p.m. and include lasagna, veggies, salad, dessert and a beverage. There will be soft drinks and wine available to purchase.

Andy Lucas, a partner in Community Development Services, will be the evening’s guest speaker. He will introduce them to the economic development resources available right now to small businesses in Lake County.

Please RSVP by June 22 to

- Details

- Written by: Redwood Credit Union

SANTA ROSA, Calif. — Steve Greig has joined Redwood Credit Union, or RCU, as senior vice president of marketing and communications.

In his role, Greig leads the marketing and communications teams, driving strategic campaigns that amplify RCU’s products and services, while ensuring consistent messaging across corporate and member communications, public relations, marketing, and social media.

Greig is a seasoned marketing executive with over 30 years of experience in building brand value, driving growth, and developing high-performing teams.

Previously, as vice president of global marketing at Visa Inc., Steve led key global marketing initiatives across more than 200 countries, including Olympics and FIFA sponsorships and cross-border marketing.

He has also led marketing teams at fintech companies, including Fundbox and One Financial, and helped build some of the world’s best known beer brands, including Heineken, Newcastle Brown Ale, Foster’s, and Beck’s.

“I’m confident that Steve’s proven track record of strategic leadership will help continue to amplify our brand and reflect the purpose, values and service excellence that define RCU,” said Mishel Kaufman, RCU’s chief operating and risk officer. “We look forward to the innovation and insight he brings to this role.”

Greig holds a master’s degree in marketing from Strathclyde Business School in Glasgow, Scotland, and an MA Hons degree in history/European studies from the University of Dundee in Dundee, Scotland. He grew up in Edinburgh, Scotland, and now resides in San Rafael with his family. He enjoys fly fishing, music, films, and spending time outdoors.

Founded in 1950, Redwood Credit Union is a full-service, not-for-profit financial institution providing personal and business banking to consumers and businesses in the North Bay and San Francisco.

For more information, call 800-479-7928, visit redwoodcu.org, or follow RCU on Facebook, Instagram, X, and LinkedIn for news and updates.

- Details

- Written by: State Controller's Office

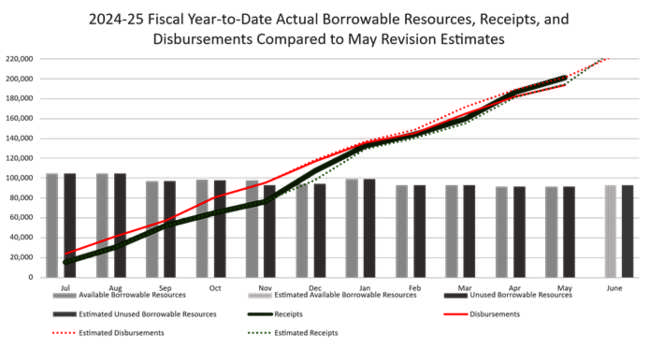

State Controller Malia M. Cohen this week released her monthly cash report covering the state’s General Fund revenues, disbursements and actual cash balance for the fiscal year through May 31.

As noted in the Controller’s Monthly Statement of General Fund Cash Receipts and Disbursements, receipts for the fiscal year through May were higher than estimates contained in the 2025-26 May Revision by $640.1 million, or 0.3 percent.

Fiscal year-to-date expenditures were $3.3 billion, or 1.7 percent, lower than Governor’s Budget estimates.

The state started the fiscal year with a $14.7 billion General Fund cash balance and ended May with a $21.7 billion balance.

“Even with rising economic uncertainty at home and abroad, the state’s strong cash position and its ability to pay its bills on time and in full continue with revenues and spending meeting expectations.” said Controller Cohen. “With the Legislature currently finalizing its spending plan for the fiscal year beginning on July 1, I encourage continued fiscal restraint coupled with maintaining reserves in the event the state faces increased volatility in its revenues or spending.”

For the fiscal year through May, personal income tax receipts were $374.4 million above May Revision projections, or 0.3 percent.

Corporation tax collections were $225.3 million, or 0.8 percent above estimates. Retail sales and use tax receipts were $255.3 million below recent projections, or 0.8 percent.

The Controller continues to note that while April 15 is the traditional annual personal income tax payment deadline, the Franchise Tax Board extended the current deadline for Los Angeles County individuals and businesses in response to the fires that began on January 7, 2025. These individuals and businesses have until October 15, 2025, to file and pay taxes.

As of May 31, the state had $91.5 billion in unused borrowable resources. These resources are from internal funds outside of the General Fund that are borrowable under state law and that the State Controller’s Office uses to manage daily and monthly cash deficits when revenue collections are lower than expenditures. Internal borrowing from special funds is short-term and is repaid so that borrowing does not affect the operations of the special funds.

The summary chart follows.

How to resolve AdBlock issue?

How to resolve AdBlock issue?