Business News

SANTA ROSA, Calif. — Steve Greig has joined Redwood Credit Union, or RCU, as senior vice president of marketing and communications.

In his role, Greig leads the marketing and communications teams, driving strategic campaigns that amplify RCU’s products and services, while ensuring consistent messaging across corporate and member communications, public relations, marketing, and social media.

Greig is a seasoned marketing executive with over 30 years of experience in building brand value, driving growth, and developing high-performing teams.

Previously, as vice president of global marketing at Visa Inc., Steve led key global marketing initiatives across more than 200 countries, including Olympics and FIFA sponsorships and cross-border marketing.

He has also led marketing teams at fintech companies, including Fundbox and One Financial, and helped build some of the world’s best known beer brands, including Heineken, Newcastle Brown Ale, Foster’s, and Beck’s.

“I’m confident that Steve’s proven track record of strategic leadership will help continue to amplify our brand and reflect the purpose, values and service excellence that define RCU,” said Mishel Kaufman, RCU’s chief operating and risk officer. “We look forward to the innovation and insight he brings to this role.”

Greig holds a master’s degree in marketing from Strathclyde Business School in Glasgow, Scotland, and an MA Hons degree in history/European studies from the University of Dundee in Dundee, Scotland. He grew up in Edinburgh, Scotland, and now resides in San Rafael with his family. He enjoys fly fishing, music, films, and spending time outdoors.

Founded in 1950, Redwood Credit Union is a full-service, not-for-profit financial institution providing personal and business banking to consumers and businesses in the North Bay and San Francisco.

For more information, call 800-479-7928, visit redwoodcu.org, or follow RCU on Facebook, Instagram, X, and LinkedIn for news and updates.

- Details

- Written by: Redwood Credit Union

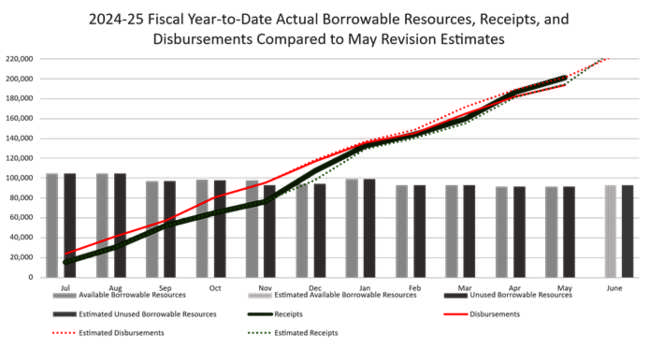

State Controller Malia M. Cohen this week released her monthly cash report covering the state’s General Fund revenues, disbursements and actual cash balance for the fiscal year through May 31.

As noted in the Controller’s Monthly Statement of General Fund Cash Receipts and Disbursements, receipts for the fiscal year through May were higher than estimates contained in the 2025-26 May Revision by $640.1 million, or 0.3 percent.

Fiscal year-to-date expenditures were $3.3 billion, or 1.7 percent, lower than Governor’s Budget estimates.

The state started the fiscal year with a $14.7 billion General Fund cash balance and ended May with a $21.7 billion balance.

“Even with rising economic uncertainty at home and abroad, the state’s strong cash position and its ability to pay its bills on time and in full continue with revenues and spending meeting expectations.” said Controller Cohen. “With the Legislature currently finalizing its spending plan for the fiscal year beginning on July 1, I encourage continued fiscal restraint coupled with maintaining reserves in the event the state faces increased volatility in its revenues or spending.”

For the fiscal year through May, personal income tax receipts were $374.4 million above May Revision projections, or 0.3 percent.

Corporation tax collections were $225.3 million, or 0.8 percent above estimates. Retail sales and use tax receipts were $255.3 million below recent projections, or 0.8 percent.

The Controller continues to note that while April 15 is the traditional annual personal income tax payment deadline, the Franchise Tax Board extended the current deadline for Los Angeles County individuals and businesses in response to the fires that began on January 7, 2025. These individuals and businesses have until October 15, 2025, to file and pay taxes.

As of May 31, the state had $91.5 billion in unused borrowable resources. These resources are from internal funds outside of the General Fund that are borrowable under state law and that the State Controller’s Office uses to manage daily and monthly cash deficits when revenue collections are lower than expenditures. Internal borrowing from special funds is short-term and is repaid so that borrowing does not affect the operations of the special funds.

The summary chart follows.

- Details

- Written by: State Controller's Office

How to resolve AdBlock issue?

How to resolve AdBlock issue?