Business News

Gas prices in California dropped for the first time in 2018, but it's unclear whether this one-week decline is a signal that cheaper gas is on the horizon for the Golden State.

California's average price for a gallon of unleaded gasoline was $3.34 on Tuesday, just one cent lower on the week.

But that small decrease put an end to 45 straight days of rising gasoline prices; California started the year with an average price of $3.10 per gallon and peaked at $3.35 last week.

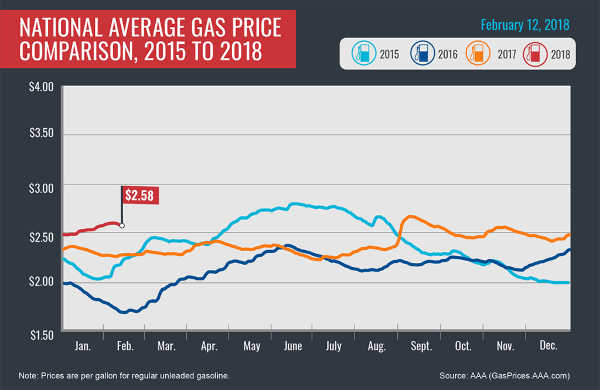

U.S. gas prices typically decrease in January and February as travel demand falls after the holiday season, but rising oil prices the last few months resulted in abnormally high prices at the pump.

Crude oil prices hovered around $50 a barrel for most of 2017, but jumped to $70 a barrel by early January 2018 after Saudi Arabia and other OPEC countries began to cut oil production.

Some analysts predicted that rising oil prices could hit $80 a barrel and push California gasoline to $4 by this May, but AAA believes that is speculative.

The Oil Price Information Service said in its 2018 outlook that $70 prices for crude oil are likely unsustainable in 2018, and after last week's stock market volatility, crude oil prices dropped nearly 8 percent. On Tuesday crude oil was selling for about $62 a barrel.

Another factor in this year's higher prices has been a strong economy on the West Coast, which means more people driving and consuming energy. Gasoline demand registered at 9.1 million barrels per day, a 169,000 barrel-per-day increase year-over year.

"California consumers should be prepared for prices to increase this year another potential 10 to 15 cents, but many market factors will drive that. Without a crystal ball, it's too soon to determine," said Michael Blasky, spokesman for AAA Northern California.

AAA’s Fuel Gauge Report is the most comprehensive retail gasoline survey available, with over 100,000 self-serve stations surveyed every day, nationwide. Data is provided in cooperation with OPIS Energy Group and Wright Express, LLC.

- Details

- Written by: Editor

SACRAMENTO – California’s total revenues of $17.35 billion for January beat the governor’s 2018-19 proposed budget estimates by $2.37 billion, or 15.8 percent, and outpaced 2017-18 Budget Act projections by $1.45 billion, or 9.1 percent, State Controller Betty T. Yee reported on Tuesday.

Personal income taxes, or PIT, and corporation taxes, two of the “big three” sources of general fund dollars, exceeded estimates for the second consecutive month and are both surpassing assumptions for the fiscal year.

For the first seven months of the 2017-18 fiscal year, total revenues of $74.56 billion are higher than expected in the January budget proposal by 4.0 percent, 7.5 percent above the enacted budget’s assumptions, and 11.7 percent higher than the same period in 2016-17.

For January, PIT receipts of $15.60 billion were $2.25 billion, or 16.9 percent, above the proposed budget’s projections and $1.33 billion ahead of 2017-18 Budget Act estimates.

For the fiscal year, PIT receipts of $54.70 billion are higher than anticipated in last summer’s budget by $3.61 billion, or 7.1 percent.

Corporation taxes for January of $551.6 million were $211.3 million, or 62.1 percent, higher than expected in the proposed budget and $143.4 million above the enacted budget’s estimates. This variance is partially because refunds were approximately $38.0 million lower than anticipated.

For the fiscal year to date, total corporation tax receipts of $4.81 billion are $1.08 billion, or 28.8 percent, above assumptions in the 2017-18 Budget Act.

Sales tax receipts of $1.01 billion for January were $138.0 million, or 12.0 percent, lower than anticipated in the governor’s budget proposal unveiled last month.

Notably, for the fiscal year, sales tax receipts of $13.03 billion are $151.2 million lower than January’s assumptions but $396.6 million, or 3.1 percent, above the enacted budget’s expectations.

Unused borrowable resources through January exceeded revised projections by $7.83 billion, or 30.8 percent. Outstanding loans of $5.64 billion were $5.19 billion, or 47.9 percent, less than the 2018-19 proposed budget estimates and $5.02 billion, or 47.1 percent, less than the 2017-18 Budget Act assumed the state would need by the end of January. The loans were financed entirely by borrowing from internal state funds.

Personal income taxes, or PIT, and corporation taxes, two of the “big three” sources of general fund dollars, exceeded estimates for the second consecutive month and are both surpassing assumptions for the fiscal year.

For the first seven months of the 2017-18 fiscal year, total revenues of $74.56 billion are higher than expected in the January budget proposal by 4.0 percent, 7.5 percent above the enacted budget’s assumptions, and 11.7 percent higher than the same period in 2016-17.

For January, PIT receipts of $15.60 billion were $2.25 billion, or 16.9 percent, above the proposed budget’s projections and $1.33 billion ahead of 2017-18 Budget Act estimates.

For the fiscal year, PIT receipts of $54.70 billion are higher than anticipated in last summer’s budget by $3.61 billion, or 7.1 percent.

Corporation taxes for January of $551.6 million were $211.3 million, or 62.1 percent, higher than expected in the proposed budget and $143.4 million above the enacted budget’s estimates. This variance is partially because refunds were approximately $38.0 million lower than anticipated.

For the fiscal year to date, total corporation tax receipts of $4.81 billion are $1.08 billion, or 28.8 percent, above assumptions in the 2017-18 Budget Act.

Sales tax receipts of $1.01 billion for January were $138.0 million, or 12.0 percent, lower than anticipated in the governor’s budget proposal unveiled last month.

Notably, for the fiscal year, sales tax receipts of $13.03 billion are $151.2 million lower than January’s assumptions but $396.6 million, or 3.1 percent, above the enacted budget’s expectations.

Unused borrowable resources through January exceeded revised projections by $7.83 billion, or 30.8 percent. Outstanding loans of $5.64 billion were $5.19 billion, or 47.9 percent, less than the 2018-19 proposed budget estimates and $5.02 billion, or 47.1 percent, less than the 2017-18 Budget Act assumed the state would need by the end of January. The loans were financed entirely by borrowing from internal state funds.

- Details

- Written by: Editor

How to resolve AdBlock issue?

How to resolve AdBlock issue?