Business News

- Details

- Written by: California State Board of Food and Agriculture

The meeting will be held from 10 a.m. to 1:30 p.m. at the California Department of Food and Agriculture, 1220 N Street – Main Auditorium, Sacramento.

The meeting is also available via Zoom, webinar ID 894 5095 3231, pass code Board2024!, and phone access passcode 8189647735. Simultaneous Spanish interpretation is available via the Zoom application.

“California’s farmers and ranchers are critical partners in helping to meet our state’s climate goals,” said CDFA Secretary Karen Ross. “From generating renewable energy and harnessing the potential of biomass, to advancing on-farm technology to reduce greenhouse gas emissions – California agriculture has many opportunities to help advance a clean energy future.”

According to the 2022 Census of Agriculture, California is the top state using renewable energy production systems – with an estimated 16,699 farms. Solar is the most common renewable energy production system on farms and ranches in the Golden State.

Invited speakers include Angelina Galiteva, Alliance for Renewable Clean Hydrogen Energy Systems (ARCHES); Tyson Eckerle, Governor’s Office of Business and Economic Development; Karen Warner, BEAM Circular; Steve Shehadey, Bar 20 Dairy; Lauren McCawley, California Department of Food and Agriculture; and other invited speakers.

“Innovation on farms will be critical to advance carbon neutrality and reach California’s renewable energy targets,” said President Don Cameron, California State Board of Food and Agriculture. “California agriculture has the potential — we need the resources, investments and partnerships to help further on-farm adaptation and integration.”

The California State Board of Food and Agriculture advises the governor and CDFA secretary on agricultural issues and consumer needs. The board conducts forums that bring together local, state and federal government officials; agricultural representatives; and citizens to discuss current issues and concerns to California agriculture.

Follow the board on X at www.twitter.com/Cafood_agboard.

- Details

- Written by: AAA

Sunny beaches and ocean cruise liners top the list of preferred destinations for Americans this spring.

While Florida remains the top domestic destination this Spring Break nationwide, destinations like Southern California, Mexico, Nevada, and Arizona are particularly popular among West Coast travelers.

Spring cruises are selling out fast, with a notable 28 percent increase in bookings for March and April compared to 2023. Similarly, international travel, particularly in Europe, is on the rise, with a 20% increase in international flight bookings compared to last year.

“We’re expecting to see a dynamic blend of travelers, from people who meticulously planned ahead to those seizing a spontaneous adventure,” AAA Northern California spokesperson John Treanor said. “Whether you booked months ahead or at the last minute, all travelers can take advantage of resources and follow practical advice to ensure a smooth and stress-free getaway.”

AAA Northern California offers five travel tips:

Plan ahead. Resources like AAA Tourbook Guides, TripTik or TripCanvas, and Via Magazine can ensure a well-planned itinerary that maximizes any vacation experience.

Prepare your vehicle. Get your car serviced at a AAA Auto Repair Center before embarking on a road trip.

Save money. Take advantage of discounts on car rentals, hotels, and find the lowest fuel prices along your route using the AAA Mobile App. AAA Members can also use the mobile app to request roadside assistance if they need it.

Stay safe. Enroll in the State Department’s STEP for safety advisories and security warnings when abroad.

Obtain an International Driving Permit. AAA is the only U.S. entity authorized to issue IDPs. Familiarize yourself with local driving laws while driving or renting a vehicle abroad.

- Details

- Written by: Elizabeth Larson

“Today we put financial institutions on notice that we will hold them responsible for customers who are cheated out of their investments,” Sen. Dodd said Friday. “When incidents of abuse and exploitation happen it is unacceptable. I thank the governor for signing this much-needed law that will require insurance agents to do what’s best for their clients. If they know an annuity is a bad fit, they will not be able to sell it.”

Senate Bill 263 is the latest consumer protection proposal from Sen. Dodd. Sen. Dodd is also authoring SB 278, which would hold financial institutions accountable for not protecting seniors when they are victims of fraud.

Also last year he introduced SB 478, which would outlaw hidden fees in an array of transactions, including banking.

In his continuing effort to protect our state’s most vulnerable, Sen. Dodd’s SB 263 would require insurance producers and insurance companies to strengthen suitability standards for the sale of annuities.

The bill would ensure California meets federal and national model standards, while providing additional consumer protections.

The goal is to prevent the sale of these financial products to people who do not understand them or would not benefit from them.

The bill is sponsored by Insurance Commissioner Lara and supported by the California Commission on Aging. It won unanimous, bipartisan support in the Legislature before being signed by the governor.

“Gov. Newsom’s signing of SB 263 puts consumers’ best interests ahead of insurance company sales of annuities,” said Insurance Commissioner Ricardo Lara, who sponsored SB 263. “This new law protects California seniors by requiring all sales of annuities be based first and foremost on the facts of their individual insurance needs, financial situation and goals. I commend Sen. Dodd for authoring this commonsense consumer protection law.”

Dodd represents the Third Senate District, which includes all or portions of Napa, Solano, Yolo, Sonoma, Contra Costa and Sacramento counties.

- Details

- Written by: ATTOM

IRVINE, Calif. — ATTOM, a leading curator of land, property, and real estate data, has released a special report on U.S. commercial foreclosures.

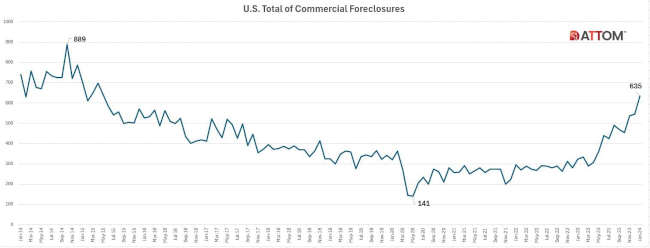

The report reveals a significant climb in commercial foreclosures over the years, from a low of 141 in May 2020 to the current figure of 635 in January 2024. This represents a steady increase throughout the period.

A decade of data driven decisions

ATTOM's analysis began in January 2014, a time when the nation was emerging from the shadows of economic uncertainty, with commercial foreclosures at 740 nationwide. Over the next decade, ATTOM tracked fluctuations, witnessing the highest spike in October 2014 with 889 foreclosures, indicating the ongoing market corrections and adjustments.

However, the trajectory wasn't a steady incline. In the face of challenges such as the COVID-19 pandemic and changing economic policies, the market displayed remarkable adaptability. While the pandemic saw an initial rise in foreclosures, the subsequent months showed a notable stabilization as businesses adapted to new market realities.

In May 2020, the United States marked a significant low in commercial foreclosures, reaching 141 commercial foreclosures, reflecting the immediate impacts of the COVID-19 pandemic and the swift response measures that followed, including moratoriums and financial aid.

By January 2024, commercial foreclosures had surged to 635, a stark contrast to the 2020 low. The 97% year-over-year increase signals a revitalizing market that is navigating through the long-term economic shifts following a global event, adapting with resilience and strategic adjustments to new commercial realities.

“This uptick signifies not just a return to pre-pandemic activity levels but also underscores the ongoing adjustments within the commercial real estate sector as it navigates through a landscape transformed by evolving business practices and consumer behaviors,” said Rob Barber, CEO at ATTOM.

State-by-state commercial foreclosure review

California, as a bellwether state, began the decade with 209 foreclosures in January 2014. Though it experienced a decrease in the following months, the foreclosure numbers saw fluctuations reflecting the state's dynamic economic climate.

By January 2024, California had the highest number of commercial foreclosures for the month, at 181. This was a 72 percent increase from last month and a 174 percent increase from last year.

New York, Texas, New Jersey, and Florida also showed significant variance over the decade, with each state's unique economic composition influencing the foreclosure rates.

For instance, New York had a total of 59 commercial foreclosures in January 2024, a 12 percent decrease from last month and a 12 percent decrease from a year ago.

Whereas Texas saw a 17 percent increase from last month and a 143 percent increase from last year. New Jersey saw a 38 percent increase from last month and a 157 percent increase from last year.

Finally, Florida saw a 18 percent increase from last month and a 42 percent increase from last year.

How to resolve AdBlock issue?

How to resolve AdBlock issue?