Business News

Gov. Gavin Newsom has signed legislation from Sen. Bill Dodd, D-Napa, in partnership with California Insurance Commissioner Ricardo Lara, that would add consumer protections for people investing in annuities, including many vulnerable seniors, to ensure they are not misled or steered into inappropriate products by unscrupulous insurance agents.

“Today we put financial institutions on notice that we will hold them responsible for customers who are cheated out of their investments,” Sen. Dodd said Friday. “When incidents of abuse and exploitation happen it is unacceptable. I thank the governor for signing this much-needed law that will require insurance agents to do what’s best for their clients. If they know an annuity is a bad fit, they will not be able to sell it.”

Senate Bill 263 is the latest consumer protection proposal from Sen. Dodd. Sen. Dodd is also authoring SB 278, which would hold financial institutions accountable for not protecting seniors when they are victims of fraud.

Also last year he introduced SB 478, which would outlaw hidden fees in an array of transactions, including banking.

In his continuing effort to protect our state’s most vulnerable, Sen. Dodd’s SB 263 would require insurance producers and insurance companies to strengthen suitability standards for the sale of annuities.

The bill would ensure California meets federal and national model standards, while providing additional consumer protections.

The goal is to prevent the sale of these financial products to people who do not understand them or would not benefit from them.

The bill is sponsored by Insurance Commissioner Lara and supported by the California Commission on Aging. It won unanimous, bipartisan support in the Legislature before being signed by the governor.

“Gov. Newsom’s signing of SB 263 puts consumers’ best interests ahead of insurance company sales of annuities,” said Insurance Commissioner Ricardo Lara, who sponsored SB 263. “This new law protects California seniors by requiring all sales of annuities be based first and foremost on the facts of their individual insurance needs, financial situation and goals. I commend Sen. Dodd for authoring this commonsense consumer protection law.”

Dodd represents the Third Senate District, which includes all or portions of Napa, Solano, Yolo, Sonoma, Contra Costa and Sacramento counties.

“Today we put financial institutions on notice that we will hold them responsible for customers who are cheated out of their investments,” Sen. Dodd said Friday. “When incidents of abuse and exploitation happen it is unacceptable. I thank the governor for signing this much-needed law that will require insurance agents to do what’s best for their clients. If they know an annuity is a bad fit, they will not be able to sell it.”

Senate Bill 263 is the latest consumer protection proposal from Sen. Dodd. Sen. Dodd is also authoring SB 278, which would hold financial institutions accountable for not protecting seniors when they are victims of fraud.

Also last year he introduced SB 478, which would outlaw hidden fees in an array of transactions, including banking.

In his continuing effort to protect our state’s most vulnerable, Sen. Dodd’s SB 263 would require insurance producers and insurance companies to strengthen suitability standards for the sale of annuities.

The bill would ensure California meets federal and national model standards, while providing additional consumer protections.

The goal is to prevent the sale of these financial products to people who do not understand them or would not benefit from them.

The bill is sponsored by Insurance Commissioner Lara and supported by the California Commission on Aging. It won unanimous, bipartisan support in the Legislature before being signed by the governor.

“Gov. Newsom’s signing of SB 263 puts consumers’ best interests ahead of insurance company sales of annuities,” said Insurance Commissioner Ricardo Lara, who sponsored SB 263. “This new law protects California seniors by requiring all sales of annuities be based first and foremost on the facts of their individual insurance needs, financial situation and goals. I commend Sen. Dodd for authoring this commonsense consumer protection law.”

Dodd represents the Third Senate District, which includes all or portions of Napa, Solano, Yolo, Sonoma, Contra Costa and Sacramento counties.

- Details

- Written by: Elizabeth Larson

IRVINE, Calif. — ATTOM, a leading curator of land, property, and real estate data, has released a special report on U.S. commercial foreclosures.

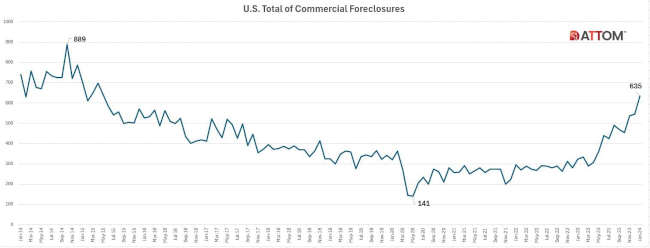

The report reveals a significant climb in commercial foreclosures over the years, from a low of 141 in May 2020 to the current figure of 635 in January 2024. This represents a steady increase throughout the period.

A decade of data driven decisions

ATTOM's analysis began in January 2014, a time when the nation was emerging from the shadows of economic uncertainty, with commercial foreclosures at 740 nationwide. Over the next decade, ATTOM tracked fluctuations, witnessing the highest spike in October 2014 with 889 foreclosures, indicating the ongoing market corrections and adjustments.

However, the trajectory wasn't a steady incline. In the face of challenges such as the COVID-19 pandemic and changing economic policies, the market displayed remarkable adaptability. While the pandemic saw an initial rise in foreclosures, the subsequent months showed a notable stabilization as businesses adapted to new market realities.

In May 2020, the United States marked a significant low in commercial foreclosures, reaching 141 commercial foreclosures, reflecting the immediate impacts of the COVID-19 pandemic and the swift response measures that followed, including moratoriums and financial aid.

By January 2024, commercial foreclosures had surged to 635, a stark contrast to the 2020 low. The 97% year-over-year increase signals a revitalizing market that is navigating through the long-term economic shifts following a global event, adapting with resilience and strategic adjustments to new commercial realities.

“This uptick signifies not just a return to pre-pandemic activity levels but also underscores the ongoing adjustments within the commercial real estate sector as it navigates through a landscape transformed by evolving business practices and consumer behaviors,” said Rob Barber, CEO at ATTOM.

State-by-state commercial foreclosure review

California, as a bellwether state, began the decade with 209 foreclosures in January 2014. Though it experienced a decrease in the following months, the foreclosure numbers saw fluctuations reflecting the state's dynamic economic climate.

By January 2024, California had the highest number of commercial foreclosures for the month, at 181. This was a 72 percent increase from last month and a 174 percent increase from last year.

New York, Texas, New Jersey, and Florida also showed significant variance over the decade, with each state's unique economic composition influencing the foreclosure rates.

For instance, New York had a total of 59 commercial foreclosures in January 2024, a 12 percent decrease from last month and a 12 percent decrease from a year ago.

Whereas Texas saw a 17 percent increase from last month and a 143 percent increase from last year. New Jersey saw a 38 percent increase from last month and a 157 percent increase from last year.

Finally, Florida saw a 18 percent increase from last month and a 42 percent increase from last year.

- Details

- Written by: ATTOM

How to resolve AdBlock issue?

How to resolve AdBlock issue?